By David K. Lifschultz

Compliments of the Lifschultz Organization founded in 1899

U.S. consumer prices soar again and push CPI inflation rate to 13-year high

The Fed printed a century’s worth of credit in last year alone to hold the ship together (4 trillion dollars that fractionalizes in the banking system). In fact, if we calculate Federal Reserve Credit to 2008 it was about 900 billion dollars for the first 94 years. While the dollar is inflating, the interest rates are held low so the foreign money is flowing out of US bonds and into stocks in the hundreds of billions of dollars. US stocks soar from foreign and domestic purchases while the Fed buys bonds to prevent a total bond collapse from foreign and domestic selling. As inflation mounts, the Fed will not be able to print more money as it would trigger hyperinflation. They will tighten money and bond yields will rise reversing the trend where now there will be massive selling of stock and buying of bonds. Foreign selling of domestic stocks will soar. Stocks will then crash as in 1929 as foreigners sell their stocks for bonds as well local US buyers dump stocks for bonds whose interest rate is rising. This will follow the concept that the trend is your friend.

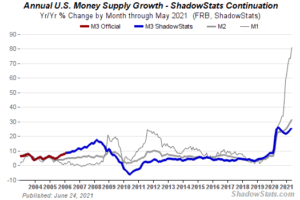

This stock market crash will trigger an implosion of the 1.5 to 2.5 quadrillion derivative market that did not exist 1929. If you divide the world GDP of 93 trillion into 2.5 quadrillion you have a multiple of 26.88. This derivative margin call would be a 1929 margin call of unimaginable size. If base Federal Reserve Credit for over 100 years is now about 8 trillion dollars which fractionalizes into a total M-2 of over 30 trillion as indicated in the chart below, then its further growth since reserve requirements were eliminated last year is theoretically infinite. If this sounds like 1920-1923 Weimar Germany is because it is. We understand that this elimination of the reserve requirement was motivated by the fear that bank write-offs in the so-called coronavirus crisis based on a manufactured medical illusion, see footnote five interview by a renowned authority, could otherwise force a contraction of bank credit from stock market crash losses precipitating further driving the economy into the ground.

The Fed also eliminated banks’ reserve requirement—the percent of deposits that banks must hold as reserves to meet cash demand.

We are quite aware that most of the 2.5 quadrillion of derivatives are notional but in a financial crisis much of that which is notional moves into the money. We are also quite aware that the Bank for International Settlements (BIS) considers the exposure to be only 582 trillion dollars or 6.25 the world GDP but our Swiss sources say this is highly inaccurate understatement to avoid panic.

BIS: The rise in gross market value in 2020 stands in sharp contrast with the relative stability of the notional amount. Overall, it decreased by 4% to $582 trillion in H2 2020.

The four trillion growth of the Federal Reserve Credit in 2020 is charted here below. You will see that in 2008 the Federal Reserve Credit totaled only 900 billion dollars since the founding of this institution in 1913-1914. That means in about 12 years 7 trillion has been additionally created or 7 times as much as in the first 94 years.

Federal Reserve Board – Recent balance sheet trends

In 1929 all you had to cope with was 10% margin for buying stock. Now, the margin in derivatives is infinitesimal. There is almost nothing there and it could be wiped out in a moment.

After the stock market crash of October 1929, the report by the Senate Committee on Banking and Currency (1934) (the “Pecora Report”) attributed the dramatic plunge in broker loans to forced margin selling during the crash. • After the October 1987 stock market crash, the U.S. Presidential Task Force on Market Mechanisms (1988) (the “Brady Report”) documented quantities of stock index futures contracts and baskets of stocks sold by portfolio insurers during the crash (euphemism for the cash settlement manipulation). • After the futures market dropped by 20% at the open of trading three days after the 1987 crash, the Commodity Futures Trading Commission (1988) documented large sell orders executed at the open of trading; the press identified the seller as George Soros.

The Brady report was conducted under Harvard Professor Robert Glauber who knowingly subpoenaed the wrong data in a cover up to conceal the rigging of the market through cash settlement by the major players which continues. This is the Wall Street cartel consisting of the major firms. The major players were instructed to reverse their market rig to undo the crash that they had created to make money in an offer that they could not refuse.

The Godfather – I’m Gonna Make Him An Offer He Can’t Refuse (HD)

See footnote three for a study of this fraudulent Brady report. It was demanded in January of this year in communications to the House Judiciary Committee and SEC that Glauber be subpoenaed by the regulatory authorities to reveal his fraud which was totally ignored as expected but he “died” shortly after that demand was made in April. Why did we make this demand? Because the rigging the Glauber covered up continues to this day. What happened during that crash of 1987 was the deep state ordered the major firms to reverse their cash settlement positions or face Stalinist consequences such as billionaire investment bankers finding themselves thrown out of forty story buildings committing “suicide”. Anyone who thinks the US is or has been different from any other police state is a fool. Note the recent prominent liquidations of Jeffrey Epstein and John McAfee in prison. This is just the tip of iceberg of slayings and frame-ups by the US Justice System that are routine for those who give the deep state trouble. If you are part of the system as Brennan and Clapper you are not even asked a question by Durham. A reversal of short derivative positions was also similarly engineered in 2008 to stop that crash.

A 2019 tweet from the antivirus software mogul John McAffee’s verified Twitter account supported the claim by his wife that he was murdered: “If I suicide myself, I didn’t,” the tweet said.

https://www.miamiherald.com/news/state/florida/article236809668.html

Now a private forensic pathologist hired by Mark Epstein to monitor his brother’s autopsy has offered an opinion that the available evidence does not support the finding that Jeffrey Epstein killed himself. Dr. Michael Baden, one of the world’s leading forensic pathologists, viewed Jeffrey Epstein’s body and was present at the autopsy — held Aug. 11, the day after Epstein was found dead at the notorious Metropolitan Correctional Center in downtown Manhattan.

If we use the Warren Buffett metaphor, the derivative implosion will have the effect of a financial weapon of mass destruction. Build back better may end up as the creation of a Frankenstein monster that goes out of control that Elon Musk likes to talk about relating to the power of artificial intelligence. The US will be end up as Weimar Germany after the collapse of Baron Louis Nathaniel Freiherr von Rothschild’s Creditanstalt Bank of Vienna that triggered the collapse of the entire German banking system precipitating the rise of National Socialism. There is a great irony here that the Rothschild rulers of the whole world self-destructed by their own control mechanism going out of control and created their nemesis Adolf Hitler as the Bible people would say measure for measure or the Proverb 11:6 of King Solomon that the faithless are entrapped in their own crafty devices. The dictator of the world Baron Eduard de Rothschild fled Paris before the advancing German Armies singing songs of hatred against usury as they marched into Paris.

https://globalfinancialdata.com/the-collapse-of-the-creditanstalt-bank

Press your fast forward button as you are in 2021. In other words, events today will be much more rapid as this is the age of instantaneous communication or the internet era. It will have the effect of a mass compression of events of uncontrollable speed.

In footnotes two and three below we were inspired by Johann Wolfgang von Goethe’s “Faust” to analyze the fraudulent basis of the entire world financial system in our essay entitled” “Goethe, Faust and the Euro” that was delivered to the Swiss Bankers in Zurich to acclaim and in Dubai before the financial community of the Middle East including the Saudi Central Bankers who said Saudi Arabia was helpless to adopt Dr. Mahathir bin Mohamad’s gold dinar standard without usury as they would be prevented by the US financial dictatorship of the fiat dollar based on the US concept that political power comes out of the barrel of the gun or gunboat diplomacy. Chairman Mao of China learned this concept that political power barrel of the gun concept from the Anglo-Saxons. Chairman Mao looked back on two heroin wars in the 19th century that humiliated China. If you are weak in the world today as in the last two centuries, you are kicked around like a dog.

A notable example of gunboat diplomacy was the Don Pacifico Incident in 1850, in which the British Foreign Secretary Lord Palmerston dispatched a squadron of the Royal Navy to blockade the Greek port of Piraeus in retaliation for the assault of a British subject, David Pacifico, in Athens, and the subsequent failure of the government of King Otto to compensate the Gibraltar-born (and therefore British) Pacifico.

Dollar diplomacy means the death sentence for Muamar Gaddafi for wishing to undermine the dollar by the gold standard and the death sentence for Saddam Hussein who switched out of the dollar to euros. Iraq sells oil for dollars now.

Here is a discussion on the change of the dollar by Saddam Hussein that caused the invasion of the country. 9-11 was to be used for this purpose but it was so botched up by Cheney, Bush and a foreign intelligence agency that the CIA demanded for covering it up that the invasion would be for Afghanistan to restart the heroin operation requiring the deposition of Mullah Omar and the Taliban. The US invasion of Afghanistan was a heroin war.

Afghanistan and the CIA Heroin Ratline

The CIA doctored the boarding tapes to show Arabs boarding the passenger planes and blamed the ailing Osama bin Laden who was a failed asset who was giving us trouble in other areas and had nothing to do with it.

https://usiraq.procon.org/view.answers.php?questionID=000911

My speech was 20 years ago though somewhat brought up to date below. Plus ça change, plus c’est la même chose, or the more things change the more they stay the same.

A manufactured illusion. Dr David Martin with Reiner Fuellmich 9/7/21